Downtown Denver Rents Tap Glass Ceiling

By Jonathan - September 28, 2016

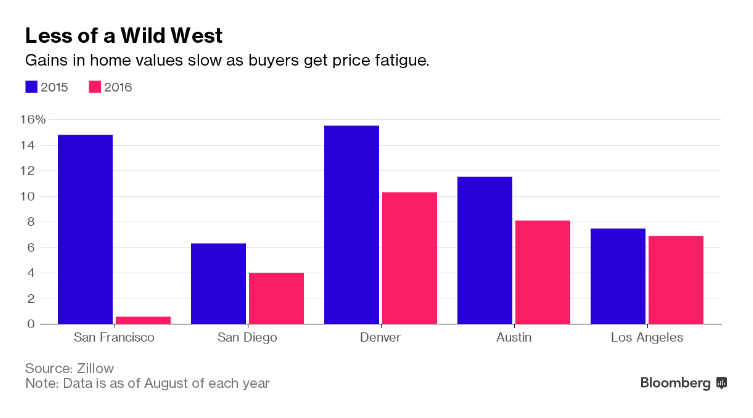

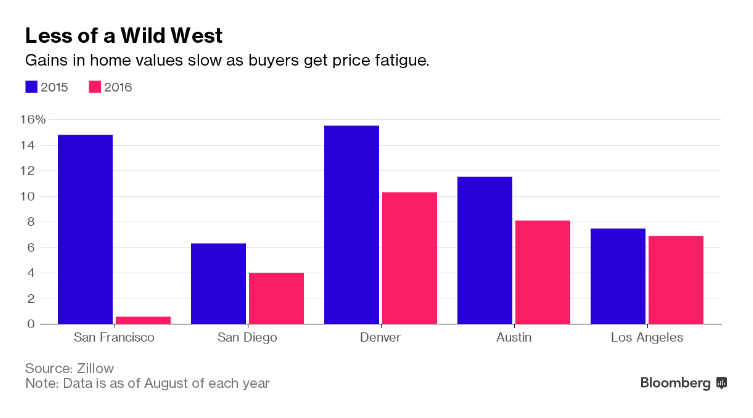

The new rental housing that developers are building in downtown Denver isn’t exactly “cheap.” In a city lacking a reasonable amount of affordable housing, the unwillingness of newer developments to lower rents in the face of slowing demand seems illogical. As the second quarter drew to an end, supply of new inventory began outpacing demand, and since then, coupled with several macroeconomic factors, downtown’s rental market has experienced the most abrupt slowdown in absorption and rent growth since 2011.

In my quarterly review published in June, I indicated the downtown submarket was experiencing a “slightly overdue correction in pricing” — this observation was particularly true for the highly sought-after condo rental market, where prices peaked in 2015 through early 2016. Since then, rental prices for condos have dropped somewhat significantly due to competition from Denver’s new luxury rental properties, eager to fill high-priced rentals by offering generous move-in concessions and minimal security deposits. Many new properties are offering 1-3 months of free rent, gift cards, and various other incentives as tactics to acquire new residents.

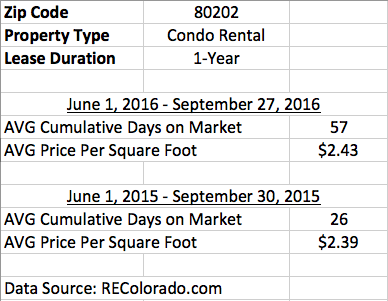

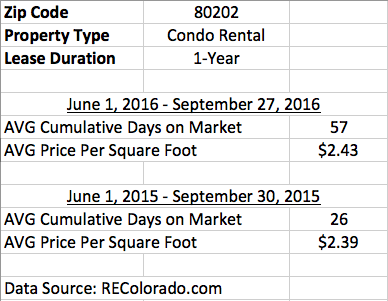

A quick snapshot of the condo rental submarket for 12-month leases in downtown, Summer 2015 vs. Summer 2016 Activity:

Today, some of the macroeconomic factors leading the lull of Denver’s leasing activity include:

Today, some of the macroeconomic factors leading the lull of Denver’s leasing activity include:

Denver is a city with a big appetite for growth. Several new downtown commercial projects with exciting spaces will be coming onto the market within the next 24 months, delivering tremendous new office square footage. New industries and companies relocating to Denver will continue to drive the need for more downtown housing. While a plateau and softening in the rental market is likely to persist for a while, glass ceilings are meant to be broken.

Go Back In my quarterly review published in June, I indicated the downtown submarket was experiencing a “slightly overdue correction in pricing” — this observation was particularly true for the highly sought-after condo rental market, where prices peaked in 2015 through early 2016. Since then, rental prices for condos have dropped somewhat significantly due to competition from Denver’s new luxury rental properties, eager to fill high-priced rentals by offering generous move-in concessions and minimal security deposits. Many new properties are offering 1-3 months of free rent, gift cards, and various other incentives as tactics to acquire new residents.

A quick snapshot of the condo rental submarket for 12-month leases in downtown, Summer 2015 vs. Summer 2016 Activity:

Today, some of the macroeconomic factors leading the lull of Denver’s leasing activity include:

Today, some of the macroeconomic factors leading the lull of Denver’s leasing activity include:

- Wages not keeping pace with rising rents

- Lack of inventory; First-time homebuyers, empty-nesters, and investors, continuing to compete for limited inventory – Driving prices and leading to mortgages exceeding what a property could lease for

- High cost for Developers to acquire and finance; Real Estate, construction labor, materials, supply and demand of general contractors and subcontractors

- Construction defects issues persist

- Rent control does not exist in Denver

- Weakening Oil & Gas Industry sector

- Notable recent sales and speculation of impending sales of large multi-family apartment complex properties

- The Presidential election in November

Denver is a city with a big appetite for growth. Several new downtown commercial projects with exciting spaces will be coming onto the market within the next 24 months, delivering tremendous new office square footage. New industries and companies relocating to Denver will continue to drive the need for more downtown housing. While a plateau and softening in the rental market is likely to persist for a while, glass ceilings are meant to be broken.